Upper line

Tesla posted a stronger third-quarter profit than Wall Street expected on Wednesday, as Elon Musk’s electric car maker reported its first year-over-year bottom-line growth in 2024.

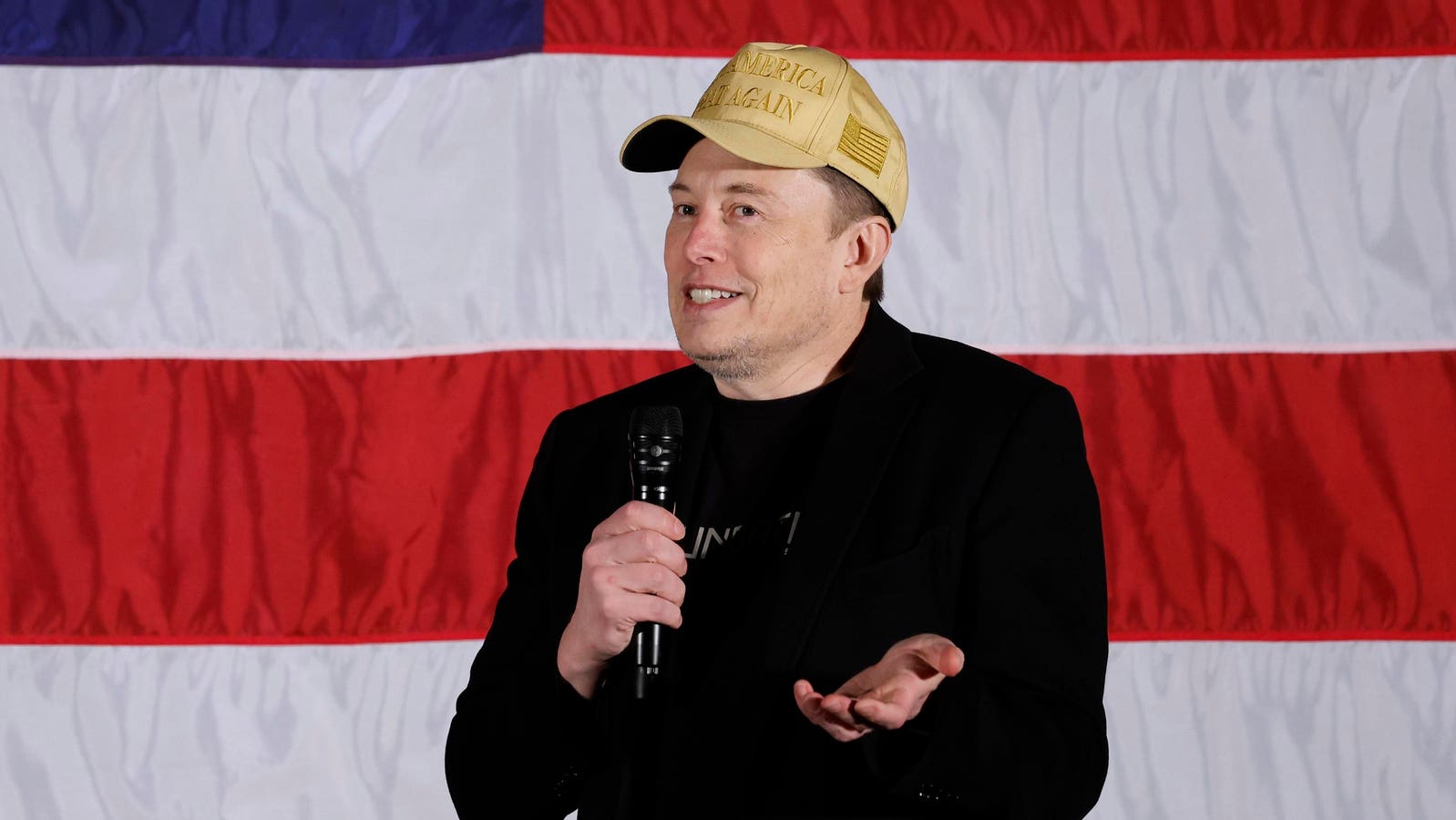

Tesla CEO Elon Musk appears at a town hall in Pennsylvania to support Donald Trump.

Key facts

Tesla brought in $0.72 in adjusted earnings per share ($2.51 billion net income), while consensus analyst estimates called for $0.59 EPS ($2.01 billion net income), according to FactSet.

On the top line, Tesla reported $25.18 billion in revenue, below forecasts of $25.47 billion.

Tesla’s sales and net income rose 8% year-over-year, ending a streak of four consecutive quarters of year-over-year profit declines as the company says it is between “two big growth waves.”

In the earnings call, Tesla noted that it expects “slight growth” in vehicle deliveries this year, another positive surprise compared to expectations, as consensus forecasts called for deliveries to slip from 2023’s 1.81 million. to 1.78 million

Tesla shares rose more than 9% in limited trading after the earnings announcement, with shares falling more than 15% in October trading at the close of regular trading hours on Wednesday.

big number

739 million dollars. That’s how much in automotive regulatory credits Tesla reported for the quarter, well above estimates of $539 million. The credits that Tesla sells to gasoline car companies so they can comply with government regulations are a big profit driver for Tesla, as the electric car maker can sell them at essentially 100% margins. The company’s earnings release noted that other automakers are “still behind in meeting emissions requirements.”

Key background

Wednesday’s earnings report caps a whirlwind three-week stretch of major catalysts for Tesla stock. The company reported its third-quarter vehicle deliveries on Oct. 2, sending shares down 3% as investors reacted to the 462,890 deliveries, which topped consensus expectations but fell short of some firms’ 470,000 forecasts. Tesla’s robotaxi day on Oct. 10 caused a steeper selloff in the evening, with shares falling 9% in the following trading session as analysts widely pointed to a lack of details and firm timelines on the company’s self-driving vehicles at the center of the event. Musk, who owns about 13% of the company’s outstanding shares and has an additional 9% pending a year-long battle in Delaware court, is the world’s richest person with a net worth of about $245 billion, according to Forbes calculations. Shares of Tesla lost nearly 15% year-to-date through Wednesday’s market close, moving against the benchmark U.S. stock index S&P 500’s more than 20% rally. Musk has told investors to hold Tesla shares only if they believe his company can solve autonomous driving.

Surprising facts

Ahead of the Q3 earnings report, consensus forecasts called for Tesla to report its worst annual net income since 2020 this year, with profits expected to fall more than 45% from 2022’s record.

Key

In addition to Tesla’s packed October, it’s been a busy period for Musk, who has appeared on the campaign trail several times in support of former President Donald Trump. Musk donated about $75 million to a pro-Trump group in July, August and September. Musk’s support for Trump comes despite the Republican nominee’s repeated skepticism about electric and autonomous vehicles, Tesla’s bread and butter.

Further reading