While many are still focused on how high the bitcoin price can go during this current bull market (although given the current price action, maybe not!), it’s just as important to prepare for what comes next. Here, we’ll look at data and math that can help us estimate where Bitcoin’s next bear market low could occur—not as a prediction, but as a framework based on past cycles, on-chain valuation metrics, and even the fundamental valuations of BTC.

Cycle Master: Modeling Historical Bitcoin Price Bottoms

One of the most consistently accurate models for identifying Bitcoin’s cyclical bottoms is what we refer to as the Bitcoin Cycle Master chart, which aggregates a number of on-chain metrics to create ties around price with certain valuation levels.

Historically, this green “Cycle Lows” line has pinpointed Bitcoin’s macro bottoms with near perfection. From $160 in 2015 to $3,200 in 2018, and again to $15,500 in late 2022. As of today, this band sits at around $43,000 and is rising daily, providing a useful baseline for estimating how far Bitcoin may fall in the next full cycle.

Declining Draws: Why Every Bitcoin Bearish Market Hurts Less

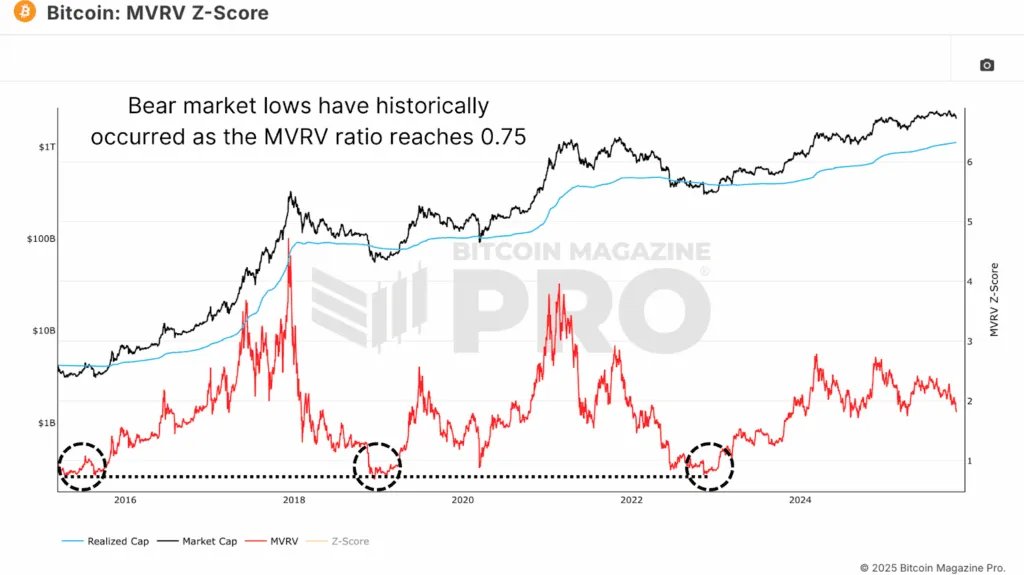

Alongside this, we can look at the raw MVRV Ratio, which measures Bitcoin’s market price versus its realized price (the average cost basis of all coins). Historically, during deep bear markets, Bitcoin tends to fall to 0.75x its realized price, meaning the market price is trading around 25% below the network’s total cost basis.

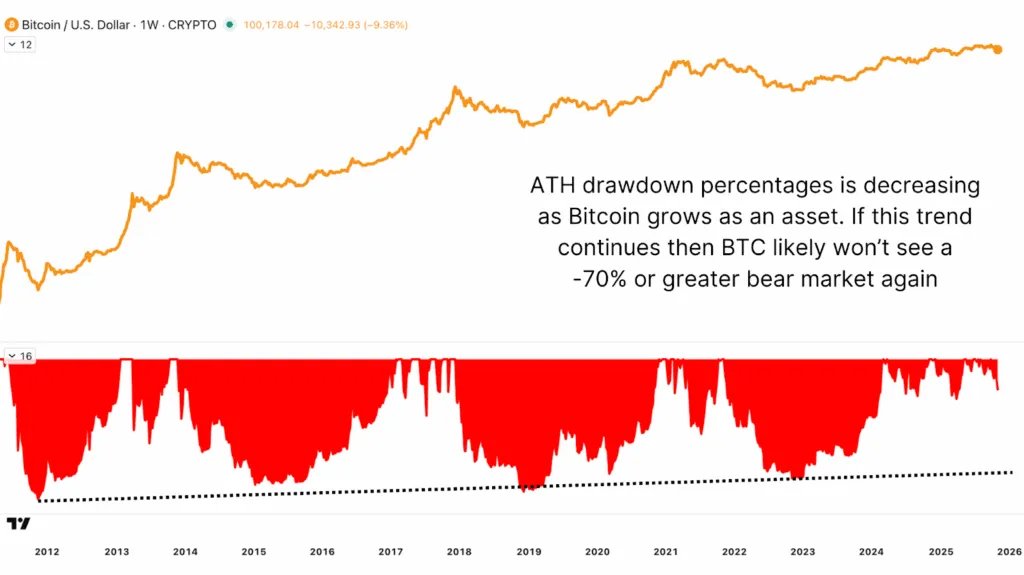

This repeatability gives us a powerful anchor for estimating potential downside when combined with the trend of diminishing impairments. While Bitcoin’s earliest cycles saw declines as deep as 88%, this figure has been steadily compressed to 80% in 2018 and 75% in 2022. Projecting the same trend forward, a continuation of declining volatility would mean the next bear market could bring a ~70% pullback.

Prediction of the next Bitcoin price top and bottom

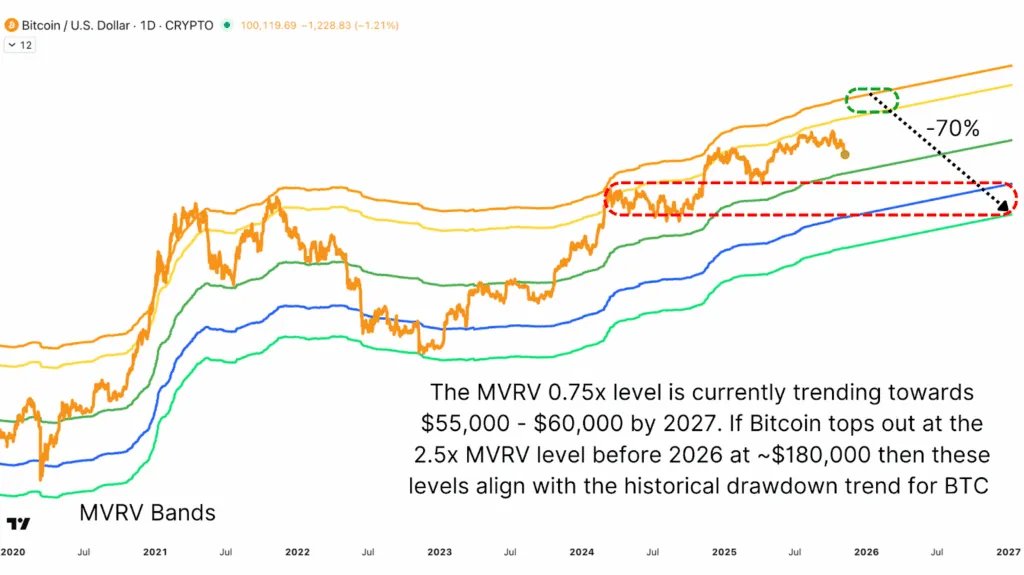

Before we estimate the next low, we need a reasonable guess as to where this bull market might top. Based on historical MVRV multiples and slope trends realized price growth, Bitcoin has recently tended to peak at around 2.5 times its realized price. If this ratio holds and the realized price continues to trend upward, it suggests a potential top somewhere near $180,000 per share. BTC at the end of 2025.

If so, and Bitcoin were to follow its historic one-year bear market lag into 2027, a 70% retracement from this level would bring the next major cycle low to around $55,000-$60,000, based on the current realized price path at that time. These prices also line up nicely with Bitcoin’s choppy consolidation area from last year to provide some technical confluence.

Bitcoin price and the rising cost of production

One of the most reliable long-term valuation metrics for Bitcoin is its cost of production, the estimated electrical expense to mine one BTC. This metric has historically been closely aligned with Bitcoin’s deepest bear market lows. After each halving, production costs double, forming an increasing structural floor under the price over time.

When Bitcoin trades below the cost of production, it signals miner stress and typically coincides with generational accumulation opportunities. From the April 2024 halving, the new cost base rose sharply, and every time Bitcoin has dipped close to or slightly below it since, it has marked local bottoms and subsequent sharp pullbacks. This value currently sits at ~$70,000 but fluctuates daily.

Conclusion: The next Bitcoin price cycle is likely to be lower

Each Bitcoin cycle has been accompanied by a wave of euphoria claiming, “This time is different.” But the data continues to show otherwise. While institutional adoption and broader financial integration have indeed changed Bitcoin’s structure, they have not erased its cyclicality.

The data suggests that the next bear market is likely to be shallower, reflecting a more mature and liquidity-driven environment. A retracement towards the $55,000-$70,000 zone would not signal collapse, but it would mark the continuation of Bitcoin’s historical rhythm of expansion and reset.

For a more in-depth look at this topic, watch our latest YouTube video here: Using Math & Data To Predict The Bitcoin Bear Market Low

Visit BitcoinMagazinePro.com for deeper data, charts and professional insight on bitcoin price trends.

Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insight and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.